One issue that causes companies to move away from QuickBooks or Peachtree is that there aren’t really good controls around posted transactions. In those systems, after a transaction is posted, the posting accounts it posted to can be changed with no audit trail. Dynamics GP does not allow this. If a transaction is posted, it must be voided or backed out with a full audit trail available at any time to see when it was backed out and why. Since Dynamics GP also has note fields, a note can also be attached to the correcting transaction to explain what happened and why.

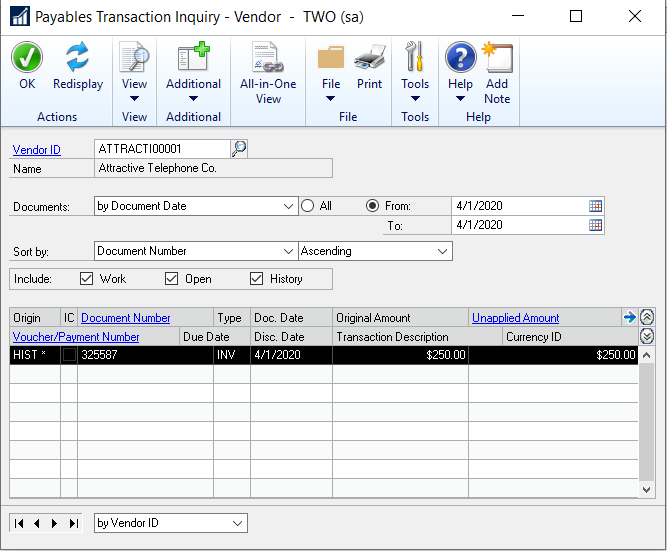

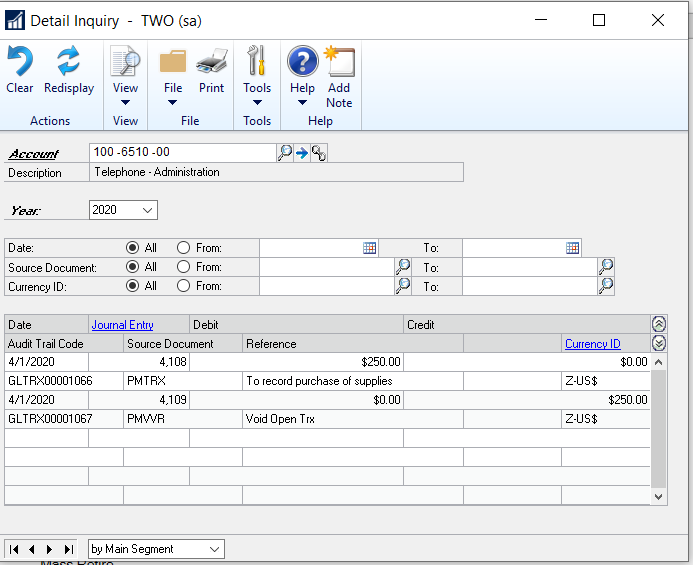

For instance, an invoice in accounts payable was posted and the wrong distribution account was used, it should have hit supplies instead of telephone expense. When the accounts payable invoice is voided, the original distribution to telephone expense and accounts payable is reversed; details of the void show in both the detail of the accounts in the general ledger and also in the accounts payable sub-ledger. In accounts payable, the invoice shows with an asterisk showing it was voided and in general ledger you see an amount going in and going out, usually on the same day.

Image 1: Detail in accounts payable sub-ledger showing the voided invoice

Image 2: Detail in general ledger showing accounts payable invoice that was voided.

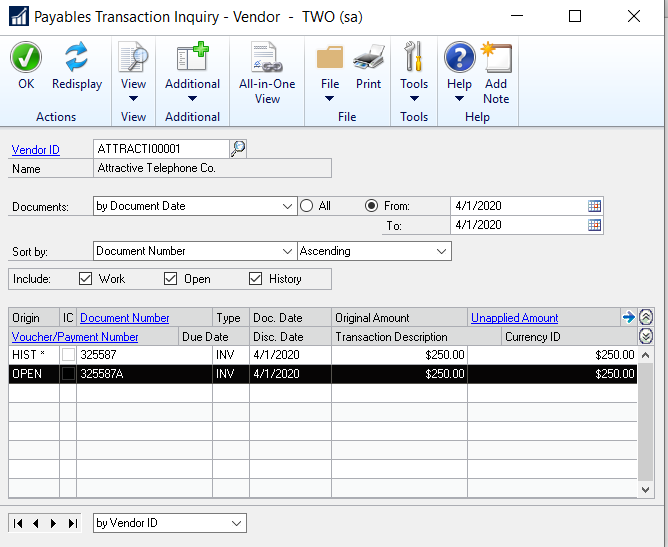

Another invoice would now be added and posted in accounts payable that posts to the correct account. A different invoice number would be used to further identify that this was a correction to a previously posted and voided invoice.

Image 3: Payables transaction record

With these posting controls, there should not be questions at month-end or year-end about amounts on financial statements that require time-consuming investigation.

For more great Microsoft Dynamics GP tips and tricks visit www.calszone.com/tips

If you are looking for Microsoft Dynamics GP support and training contact CAL Business Solutions at 860-485-0910 x4 or sales@calszone.com

By Stephanie Olbrych, CAL Business Solutions, www.calszone.com