The team at Microsoft is starting to see a trend in 2023 where some states are decreasing their tax rates, we all know employees want more money in their pocket, so this calls for them to release Dynamics GP Payroll 2023 Round 3 tax table changes for the year 2023.

Once you install this update the tax date under Tools | Setup | System | Payroll Tax is 4/9/2023

States that changed in this update are:

- District of Columbia

- West Virginia

- Michigan

- Utah

Reminder: tax updates are all inclusive of prior updates.

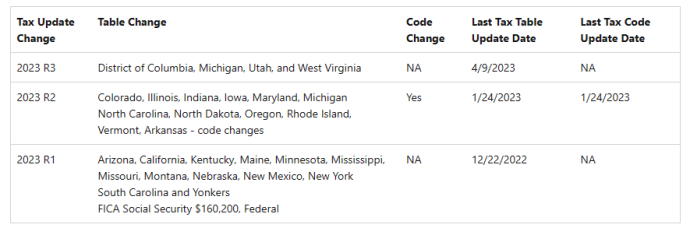

Here is an overview of the changes Microsoft has had so far this year from the tax download page

It is also that time of year where everyone is doing their taxes and maybe withholdings were not what they expected for the 2022 year.

Here are some important links when calculating payroll tax in Dynamics GP that will help you.

- Payroll Tax Documentation for the 2023 year of changes

- Tips to install the Payroll Tax Update

- How does Microsoft Dynamics GP calculate payroll tax? We annualize everything!

- How does Microsoft Dynamics GP calculate payroll tax with Dependent Claim Amount?

- Payroll W-4 and how does it correlate to Dynamics GP.

If our Dynamics GP customers need assistance with installing this update, please contact us to schedule a time with our consultants to complete this.

By CAL Business Solutions, Connecticut Microsoft Dynamics GP & Acumatica Partner, www.calszone.com

Read the original post at: https://community.dynamics.com/blogs/post/?postid=61db8571-d3e2-49e7-b680-3db822db98dd