It is time to prepare for completing and sending out employee Form W2 and employer Form W3. Use this blog to guide you with creating the W2 and W3 forms and if you have questions, we most likely have the answer listed in this blog.

For the 2023 year, there are no W2, W3 form changes or electronic filing changes.

RECOMMENDATION: Create the Year-End Closing and Year-End Wage file a couple of times in the current year (2023): This can be done in a test company refreshed with live company data Set up a test company in Microsoft Dynamics GP. If you do this in the live company, be sure to always make current restorable backups.

- Prior to running the last payroll of the year. This allows you to validate and correct records if needed with the 2023 tax tables still installed.

- After processing the last payroll of the year and before installing the next year’s tax tables (2024). This allows you to validate and correct records with the current year’s tax tables still in place.

Here is why: If you validate the current year’s employee’s W2 and know they are accurate BEFORE next year tax tables are installed and the first payroll of the next year is run, this will save you from doing a lot of unwanted steps.

If you must correct W2 data after installing the new year’s tax tables 2024, you will need to re-install the 2023 tax tables, make corrections, print the W2, then re-install the 2024 tax tables again. A lot of steps can be avoided if you are able to validate the 2023 W2 data prior to installing the 2024 tax tables, or wait to install the 2024 tax tables till you are done with W2 processing.

Where does the information in the W-2’s come from?

Year-End Closing: HR & Payroll >> Routines >> Payroll >> Year-End Closing

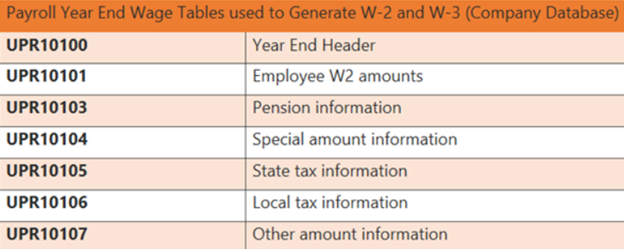

When a year is closed in the payroll module, Microsoft Dynamics GP populates the Payroll Year End Wage tables, which are used to generate the Year-End Wage file to generate your W-2’s and W-3.

Year End Wage Report: HR & Payroll >> Routines >> Payroll >> Year-End Wage Report.

Use the Year-End Wage Report to verify W-2 amounts before printing W-2 statements. This report can be created as many times as you wish.

If an employee’s record needs corrections/changes/edits to ensure their W-2 is accurate after the Year-End Wage File has been created there are 2 options for you to use.

NOTE: Always make a backup of the databases prior to making any changes.

Option 1 – Manually Edit W-2’s (most common):

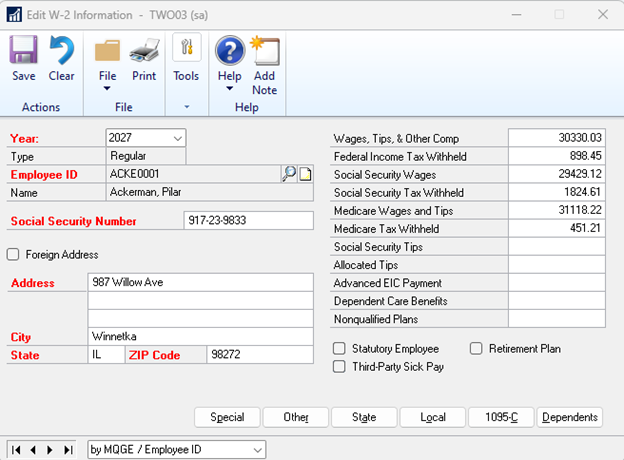

Manually edit the W-2 via the Edit W-2 Information window (Microsoft Dynamics GP >> Tools >> Routines >> Payroll >> Edit W-2).

Note: Changes made here will update the Payroll Year End Wage tables only. These changes are not reflected in any other tables in the payroll module.

If you remove the Year End Wage File for any year, ALL edits made manually via the Edit W-2 Information window are lost. This is because removing the year-end wage file removes data from all the Payroll Year End Wage tables for the year in question.

Option 2 – Remove Year-End Wage File, make changes, and recreate Year-End Wage File: NOTE: This can be done as many times as you want, just remember, if you choose this option for any manual edits, you’ve already in the Edit W2 Information window W-2’s will be lost.

- Ensure no users are processing in Payroll system wide.

- If needed re-install 2023 tax tables

- Remove the Year-End Wage file for the appropriate year Microsoft Dynamics GP >> Tools >> Utilities >> Payroll >> Remove Year End Information >> select the year you want to remove.

- Make needed changes in Payroll (whether that’s voiding checks, processing checks, fixing W-2 labels, processing manual checks, etc.)

- Once you have verified all data is accurate, close the Payroll year again HR & Payroll >> Routines >> Payroll >> Year-End Closing

- Verify changes updated the Year-End Wage file and W-2’s is as expected.

- Make another backup.

- If needed, re-install 2024 tax tables prior to any further processing in Payroll for the 2024 payroll year (Microsoft Dynamics GP >> Maintenance >> US Payroll Updates >> Check for Tax Updates).

Make sure to check out Microsoft’s W-2 / W-3 Changes FAQs

W-2 and W-3 Resources:

- U.S. Year-end Update – Microsoft Dynamics GP

- W-2 Wage and Tax Statement data source

- General Instructions for Forms W-2 and W-3

- 2023 Form W-2

- 2023 Form W-3

- Microsoft Business Checks – Hard copy W-2 Forms 800-432-1281

- Specifications for filing forms W-2 and EFW2

- Accuwage

- Payroll Documentation

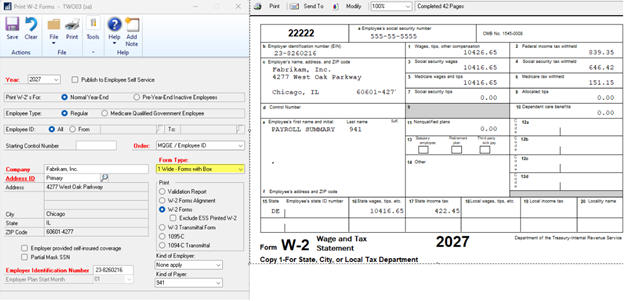

Remember, you have the ability print W-2’s with lines on blank paper. The Form Type 1-Wide Forms with Box to accomplish this go to Microsoft Dynamics GP >> Routines >> Payroll >> Print W-2’s >> Form Type = 1 Wide- Forms with Box >> Print = W-2 Forms):

Note: GP only prints the black form with lines, not the red form. Most customers electronically file so the red forms do not need to be purchased, just file electronic for FREE.

If you need to purchase hard copies of Form W2, Microsoft recommends checking out Microsoft Business Checks. These are the forms we GP uses; therefore, the data and boxes should align.

Be sure to refer to the 2023 Year-End Blog Schedule to review current and upcoming blog posts and other helpful resource links related to Year-End Closing for Dynamics GP.

CAL is here to assist our Dynamics GP customers with their year-end update/closing so please don’t hesitate to contact CAL Support at Support@calszone.com to schedule a time with one of our consultants so your year-end goes smoothly.

By CAL Business Solutions, Connecticut Microsoft Dynamics GP / 365 BC & Acumatica Partner, www.calszone.com

Read the original post at: https://community.dynamics.com/blogs/post/?postid=4ab6f4d3-be87-ee11-a81c-6045bdb8c79a