Have you ever dreamt of a finance buddy who could anticipate your every need, help you dodge every curveball, and make sure that every single digit in your finance reports shine? Enter Microsoft Copilot for Finance — your all-star finance champion. Pull up a seat, grab a cup of your favorite brew and let’s dive into the benefits of Microsoft Copilot for you.

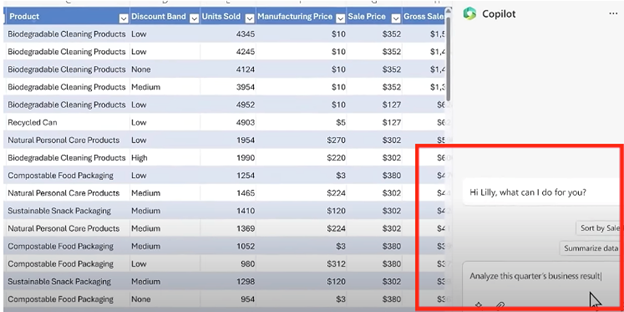

Copilot for Finance includes Copilot for Microsoft 365, which means it supercharges Excel, Outlook and other widely used productivity apps with workflow and data-specific insights for the finance professional. Copilot for Finance draws on essential context from your existing financial data sources, including your ERP system, Dynamics 365 Business Central.

Let’s take an in-depth look at Microsoft Copilot’s AI capabilities within Dynamics 365 Business Central, focusing on how it’s redefining financial tasks by providing quicker solutions, generating innovative content, and anticipating business challenges. But what does this really mean for finance professionals and users of Business Central, and how is Copilot making complex tasks appear deceptively simple?

Understanding the Role of Copilot in Your Financial World

Imagine an intelligent, cognitive assistant that helps you traverse the labyrinth of financial operations without missing a beat. Microsoft Copilot is precisely that – a futuristic aide integrated into the very fabric of Business Central, attuned to your needs and ready to supercharge your productivity.

Through advanced natural language processing (NLP), Copilot decodes human input and executes actions with uncanny swiftness. This spans from supporting with bank reconciliations with transaction analysis to assisting with inventory forecasting, curbing late payments, and offering a cash flow analysis that paves the way for better financial planning.

And the most astonishing part? All these features are part of your Business Central Essentials and Premium licenses, at no added expense. But how do you leverage a tool that’s both powerful and free to its maximum potential?

Harnessing Copilot’s AI Wisely

Are you still spending hours on mundane number-crunching tasks? Imagine slashing those hours down to minutes. With Copilot for Finance, that’s now a reality. It’s like giving your finance operations a much-needed tune-up; suddenly, you’re automating workflows, moving past errors, and you have more time on your hands.

“The accounts receivable reconciliation capabilities help us to eliminate the time it takes to compare data across sources, saving an average 20 minutes per account. Based on pilot usage, this translates to an average of 22% cost savings in average handling time.” —Gladys Jin, Senior Director Microsoft Finance Global Treasury and Financial Services

While Copilot’s wealth of features is vast, without a means to validate AI-generated suggestions, users must understand that it is a tool that supplements human intuition and expertise, not replaces it.

Copilot for Finance offers several key features to enhance your financial operations:

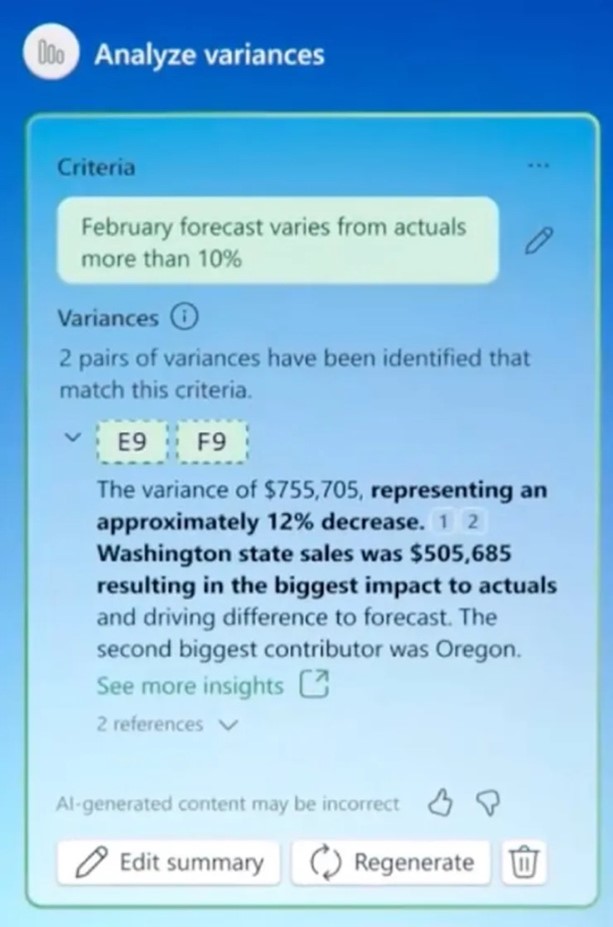

- Helps financial analysts quickly conduct a variance analysis in Excel using natural language prompts to review data sets for anomalies, risks, and unmatched values. This type of analysis helps finance provide strategic insights to business leaders about where it is meeting, exceeding, or falling short of planned financial outcomes and why.

- Simplifies the reconciliation process in Excel with automated data structure comparisons and guided troubleshooting to help move from insight to action, which helps ensure the reliability and accuracy of financial records.

- Provides a complete summary of relevant customer account details in Outlook, such as balance statements and invoices, to expedite the collections process.

- Enables customers to turn raw data in Excel into presentation-ready visuals and reports ready to be shared across Outlook and Teams.

Data with a Dash of AI Insight

This isn’t just about being quicker than before with numbers. Copilot for Finance is like your very own financial oracle. It’s all lined up with Dynamics 365 Business Central, and it’s serving up advanced analytics that’ll have your informed decision making faster than ever. An example would be a user can ask Copilot “help me understand forecast to actuals variance data.” It can also pull insights and update actions back to existing sources, Copilot streamlines workflow and task completion. Think of it as nudging your financial strategy toward the success wanted by your company.

AI’s potential is limitless, and when capitalized on effectively, its impact on the world of finance is profound. With each innovation, we transition towards a reality where AI isn’t just a tool; it becomes a reliable partner in our professional lives. Here are a few concrete examples of how Copilot is reshaping finance within Dynamics 365 Business Central:

Revolutionizing Marketing Content

Copilot’s foray into creative content generation has altered the way products are presented to customers. By suggesting marketing text, it is refining sales pitches and product descriptions, fostering a more engaging and profitable customer relationship.

Enhancing Data-Driven Decision-Making

Its assistance with inventory forecasting and replenishment ensures that stock management is not guesswork. By crunching numbers and considering historical trends, Copilot supports in making data-backed decisions that minimize waste and maximize sales opportunities.

Safeguarding Financial Stability

Predicting and managing late payments can dramatically improve an organization’s financial stability. Copilot flagging potential issues beforehand not only keeps your finances in check but also underscores the platform’s role in proactive, anticipatory finance management.

Augmenting the Role of Finance Professionals

By handling mundane, time-consuming tasks with precision and speed, Copilot frees up finance professionals’ time. This allows them to focus on higher-value activities, such as strategic planning and fostering innovation within the organization.

The Future is Here – Are You Ready for Your Copilot?

The synergy between AI and finance is unfolding into an unparalleled partnership that promises to redefine operational standards. Dynamics 365 Business Central with Microsoft Copilot is not just a tool; it’s a testament to the brand’s vision to democratize AI and make it an indispensable part of our daily business routines.

It’s an exciting new chapter in the world of finance – a chapter that invites collaboration, innovation, and strategic foresight. For finance professionals and Business Central users, the onus is to master this new technology and utilize it to lead their organizations towards a prosperous, AI-integrated future.

Take the first step today to unlock the full potential of Copilot in your Dynamics 365 Business Central. Experiment, learn, and adapt your strategies to leverage this innovative tool, and in doing so, nurture a finance department that’s not just future-proof but future-leading. The future is AI, and it’s here to stay.

Ready to supercharge your finance adventure? Contact our team of experts at CAL and we can help get you going with Microsoft Copilot for Finance today.

Learn more: Transform the way work gets done with Microsoft Copilot in Dynamics 365 Business Central

By CAL Business Solutions Inc., Connecticut Microsoft Dynamics GP / 365 BC & Acumatica Partner, www.calszone.com