Well, folks, it looks like you’re all deep in the year-end frenzy, juggling planning sessions and prepping like pros. “It’s the most wonderful time of the year!” (Cue the holiday music and maybe a little dance break!) The good news, for GP Year-End ACA the 2024 year, the form, 1095-C is a very small change on the back page of the instructions, that is it! This update was included in the 2024 Year-End Update released in November 2024. If you remember how, you did it last year it should be all the same process wise.

One item I would like to call out would be the electronic filing, like the W2’s and 1099’s the ACA forms are included in this count. It is very important you file electronically this year for all your forms to the IRS. Review #6 below.

Check out the ACA VIDEO and SLIDES for setup and ACA troubleshooting.

***Make sure you are printing the ORIGINAL form, and you do not have security set to an older modified version of the 1095-C form***

A few tips for you as we file these forms.

1. The Plan Start Month was required started with the 2020 year. This is calculated based on the Employer plan start month.

Plan Start Month should indicate the beginning of the plan year for the health plan that was offered to the employee. For example, if an employer’s plan year begins in January for all of its employees, the employer will complete the plan start month box for all of its Forms 1095-C with 01. However, if an employer’s plan year operates on a fiscal year of July through June for all of its employees, the employer will complete the plan start month box for all its Forms 1095-C with 07.

Microsoft also added this as a field in the Print W-2 window for you to populate to print on the forms.

2. As prior years, the Employee’s Age will be calculated and printed on the form. If the employee date of birth is not populated on the employee record, the age will not calculate correctly, see below example.

The age will be calculated on the fly when you print the 1095-C form, it is not stored when you create the year end wage file. It takes the year the year end wage file is created minus birthday year.

The employee birth date is stored under the Additional Information window from the main employee maintenance record, table UPR00100 field brthdate

select birthdate, * from UPR00100

3. Changes were made in the system to ONLY print the dependents page 3 when Employer provided self-insured coverage is MARKED in the Print W-2 window. (Prior it would print page 3 all blank when some customers do not use this form)

4. Inactive employees –Per ACA guidelines, you cannot leave a box blank/empty, so when employee Joe leaves the company, what customers do is put 2A in Box 16 – meaning Employee not employed during the month.

Remember, it is when you click the PRINT button for the 1095-C form, if an employee is 2A for all 12 months, the form will not print. I feel this is a great indicator to go by. You will see the employees get compiled in the year end, (in case you need to edit this employee and make changes to the record) but when you go to print, those employees will not be included.

If you did not get all your employees / codes set correctly, here is a nice script that will remove all inactive employees for you:

and b.WGTPCOMP = 0

This removes employees that have no wages in the year, if you are using payroll, we assume employees would have wages. Backups are always recommended.

5. Multiple insurance plans (dental and vision examples) dishevel the 1095-C reporting.

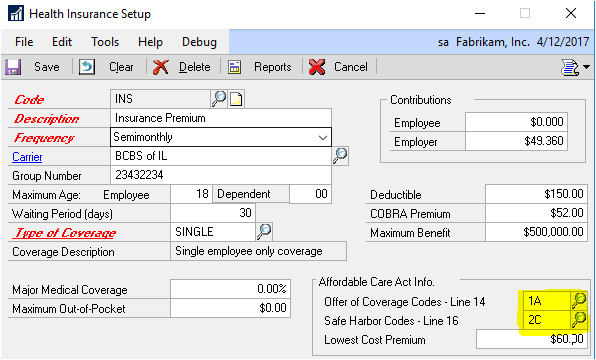

As Microsoft painfully worked with customers on this reporting YOY another area that was causing ACA data inconsistencies was insurance codes that are non ACA reportable, such as Vision or Dental as an example. If I had a health insurance code that did not change all year, then I added Dental, we would grab that “None” record as that was the newest record for the year. How we decided to “identify” true ACA recordable codes is from the Health Insurance Setup on the Human Resource side. The field we will use to determine if the code is ACA recordable is at the Setup, None and None. Then we will not include this code when we create the year end wage file.

Most of you have this properly set already based on prior year learning.

What we need you to make sure and do is at the SETUP for your health codes you want ACA recordable, make sure you do not have None and None.

Pick a default that would suite most of your employees, such as 1A and 2C as an example.

This code will NOT be picked up for ACA reporting.

This code will be picked up for ACA reporting as Box 14 and 16 are something other than None

6. Microsoft Dynamics GP will NOT support the electronic filing for the 2023 year for ACA.

Greenshades and Integrity-Data will allow you to track ACA in Microsoft Dynamics GP, and just do the electronic filing for you at a lower cost option. Thanks to both ISV’s for doing this!!

Greenshades – https://go.greenshades.com/ Integrity Data – http://www.integrity-data.com/

7. Similar to prior years, the all 12-month checkbox is not required for employee, so we are populating each individual amount for employee, but on the dependent the covered all 12-month box will be populated.

8. When you need to change what is reporting for an employee for a month, change the user date to the end of that month. For example, you want to change the month of March and on, set the Microsoft Dynamics GP user date to 3/31/2024 make your record change, and recreate the year end wage file and you will see the change, you can also do this by rolling down from setup by a date. We always take the last record of the month for what should print on the form.

9. We have had a couple of requests where a few forms have been rejected by the IRS. Make sure if you are submitting forms, the 1094-C, we only print 1 page as that is all that is in Dynamics GP for information, but the form is actually more pages. Make sure to complete the entire 1094-C prior to sending into the IRS.

Click HERE for the FREE SmartList Designer reports library, free to you, it includes ACA SmartLists for you and many more!!

See video above and click HERE if you are just getting started to track GP Year-End ACA and want to ramp up.

Enjoy, and everyone have a successful ACA 2024 year.

Be sure to refer to the 2024 Year-End Blog Scheduleto review current and upcoming blog posts and other helpful resource links related to Year-End Closing for Dynamics GP.

CAL is here to assist our Dynamics GP customers with their year-end update/closing so please don’t hesitate to contact CAL Support at Support@calszone.com to schedule a time with one of our consultants so your year-end goes smoothly.

By CAL Business Solutions, Connecticut Microsoft Dynamics GP / 365 BC & Acumatica Partner, www.calszone.com

Read the original post at: https://community.dynamics.com/blogs/post/?postid=573e31d9-09b1-ef11-b8e8-7c1e5246cd7c